Business Insurance in and around Little Falls

One of the top small business insurance companies in Little Falls, and beyond.

Almost 100 years of helping small businesses

- Little Falls, MN

- Pierz, MN

- Randall, MN

- Fort Ripley, MN

- Swanville, MN

- Royalton, MN

- All of Minnesota

Business Insurance At A Great Value!

Operating your small business takes effort, time, and outstanding insurance. That's why State Farm offers coverage options like worker's compensation for your employees, business continuity plans, a surety or fidelity bond, and more!

One of the top small business insurance companies in Little Falls, and beyond.

Almost 100 years of helping small businesses

Protect Your Future With State Farm

When you've put so much personal interest in a small business like yours, whether it's an arts and crafts store, a lawn sprinkler company, or a book store, having the right insurance for you is important. As a business owner, as well, State Farm agent Jordan Hansel understands and is happy to offer customizable insurance options to fit the needs of you and your business.

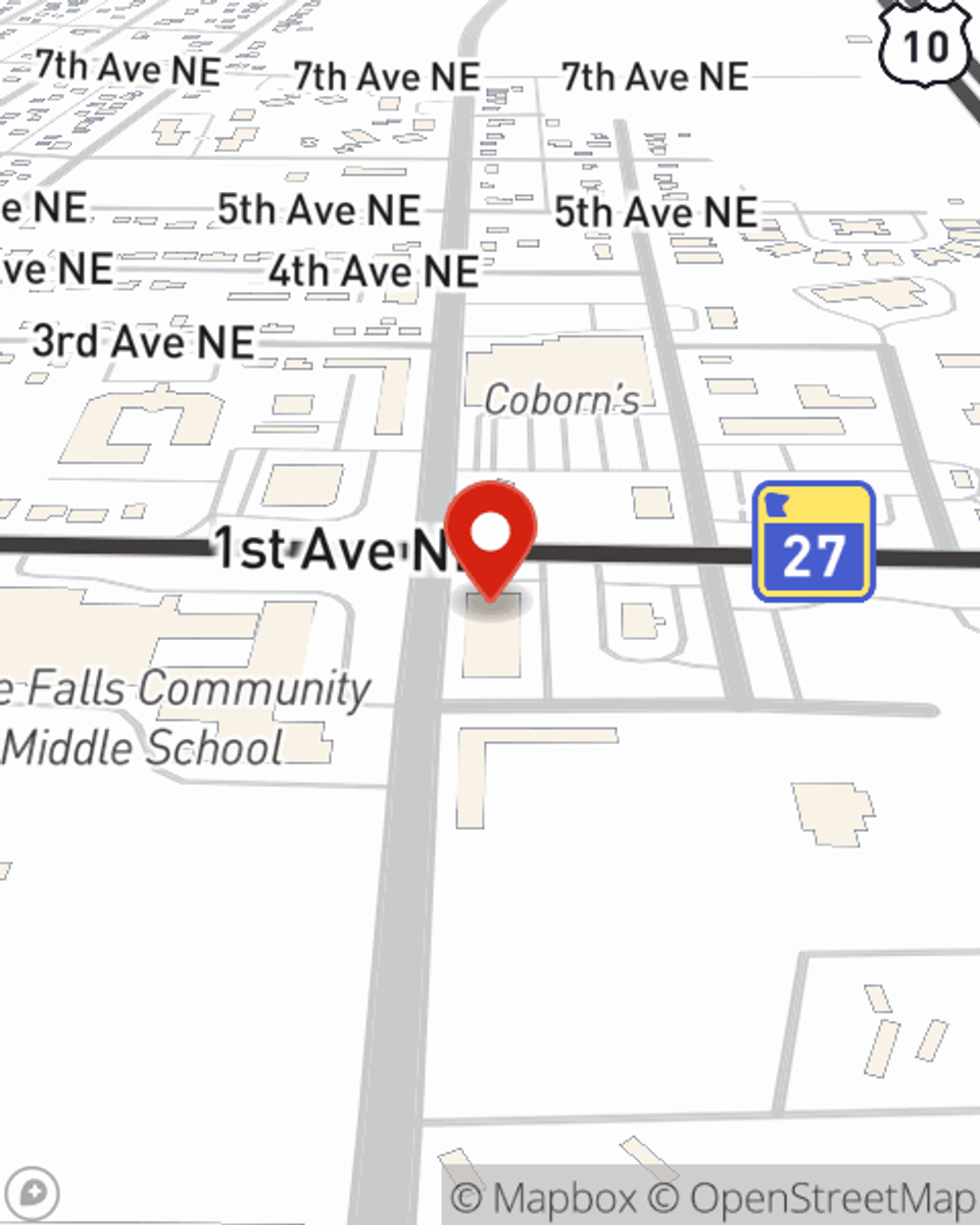

Ready to talk through the business insurance options that may be right for you? Visit agent Jordan Hansel's office to get started!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Jordan Hansel

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.